How to Access Property Records in West Virginia

West Virginia has more than 1,770 million residents and 893,778 housing units. This state produces many property records created by local government offices, courts, attorneys, appraisers, tax and building officials, title companies, realtors, insurance agents, and private companies. These records are essential to homeowners as they transfer ownership, verify title, and perform other property-related functions.

Government Sources

Life would be much easier if all property records were stored in the same place. However, they are not; they are spread among many different offices, agencies, and companies. If you buy a house in West Virginia, you will file the deed with the county court clerk's office. Deeds must be witnessed (2 people) and notarized to be official.

Unlike most states, property taxes and bills are issued through the County Sheriff in West Virginia. Local County Tax Assessors set tax rates, and if you have an issue, you must take it up with the county Tax Commissioner. The West Virginia Tax Division oversees these local tax officials.

If you want to build something new, renovate an existing structure, or demolish a building, you need a building permit. You can apply for one with the county office in charge of buildings. This varies by county. Use this list to find the correct office to submit your application before starting the work.

Property records grow over time and can become unmanageable. When this happens, states like West Virginia move older records to archives and keep current ones on hand. The West Virginia and Regional History Center has historical property records dating back to the early 1800s.

![]() Online

Online

Many courts put these records online so the public can access them. However, if you need records from a county that doesn't put them online, you can always visit in person during regular business hours to ask for them. Here are a few of the county websites to help get you started.

![]() In Person

In Person

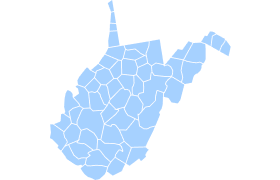

If you need certified copies of records, the best place to go is the county court clerk's office. You can request them by paying a small fee per page and visiting during regular business hours. To help you find the proper county court clerk's office, use this handy map and click on the area that you need to access.

![]() Commercial Sources

Commercial Sources

Commercial services make it easy to find property and related records quickly and easily, saving you much time. When signing up, you may also receive access to records beyond what is present in public records. PropertyChecker.com offers nationwide property searches. Using PropertyChecker, you can search by property address, parcel ID, owner's name, phone, or email, and you can save time by running unlimited statewide or local searches 24/7. Instead of visiting multiple websites or visiting local government offices, you can find all the data points you need in one comprehensive report.

What Information Can You Find in West Virginia Property Records?

A property history search will reveal many details about the property and its owners. Some records contain a lot of information, and others less. However, you can see the whole story if you obtain all of them.

Some of the things that a property history search may reveal include:

-

Liens

-

Tax Records

-

Ownership History

-

Mortgage / Loan Records

-

Foreclosures

-

Plat Maps

-

Easements / Conveyances

-

Property Details

-

Zoning

-

Building Permits

-

Boundary Lines

-

Assessed Values

-

Deeds

-

And More!

What Are Property Records?

West Virginia property records are official legal documents that contain vast information about real property and its owners. Many industries use them daily. Some records perform functions like transferring ownership or providing a license to renovate; others, like an appraisal or tax bill, are informational only.

In West Virginia, land and property records are considered the same thing. However, they can become overwhelming as they grow, so the state moves some of the older records to archives. Many older property records reside only on microfilm. You can access these records through the Library of Virginia. They have deeds, wills, court papers, marriage bonds, and slave records dating back to 1863.

Types of Property Records in West Virginia

When performing a property history search, you will encounter various types of property records, each with its own function. Different sources and events generate these records. Most often, real estate sales prompt new property records.

Deeds and Conveyance Records

Deeds are very common property records that transfer ownership and verify title. They are recorded by the West Virginia local county court clerk, and they are public records. If you need to verify the ownership of the property, a deed will suffice.

All parties must sign deeds, and a notary must witness them. Some of the information contained in deeds includes:

- Name of the Seller/Grantor and Buyer/Grantee.

- A detailed description of the property.

- Maps and plats along with boundaries and sometimes surveys showing the acreage and edges of the property.

- Conveyance language explaining the ownership transfer from one person or entity to another.

- Notarization and execution are at the bottom, where everyone signs to make it legal.

Much of the language contained in deeds refers to the warranty implied or specified and the conveyance of the land from one or more parties to another.

Property Tax Records

Everyone who owns property in West Virginia must pay annual property taxes. These taxes pay for things like schools, road maintenance, local government salaries, and emergency services. The local county tax assessor sets tax rates for the area. West Virginia has the 10th lowest property taxes in the county, with an average effective property tax rate of 0.55%. Homeowners pay an average of $1,682 per year.

The local county sheriff issues tax bills and collects payments. If you fail to pay your annual taxes, they will also impose a tax lien on the property and eventually foreclose and sell it at auction.

Some of the information in a standard tax record in West Virginia includes:

- Exemptions - The document will outline the property's exemptions. These are tax reliefs that may reduce the taxes owed.

- Tax Rates - The record will show the various tax rates applying to the property and the resulting taxes. Each jurisdiction has different tax rates.

- Property Details - The document should provide details about the property for correctness and validity.

- Taxpayer Details - The statement must name the taxpayer and provide details such as address or phone number.

- Tax Calculations - The record may show a breakdown of the tax calculations.

- Approved Payment Methods - The statement will include how owners can contribute towards their taxes.

using our property tax calculator.

Building Permits and Regulations in West Virginia

Building permits are handled at the county level. Each county has a different department that handles applications. The West Virginia Home Builders Association created this list to help you locate the building permit application office that you need.

Property Liens and Encumbrances in West Virginia

Encumbrances like liens can damage a property and its owner's reputation. Too many liens indicate serious financial problems. There are two main types of liens: voluntary and involuntary.

Voluntary Liens

When you use your home as collateral to secure a loan, you can choose voluntary liens. An example would be a mortgage, home equity loan, or other legally binding agreement that uses your home as collateral. Even though these are voluntary loans, you can still lose your home if you default on the loan.

-

Mortgage Liens - Mortgage liens are extremely common. Anyone who borrows money to buy a house will have one. The key is to stay current with payments. Otherwise, the lender can foreclose and sell your property to get their money back.

Mortgages are recorded with the County Clerks containing information such as:

- Names and Addresses - The identification and addresses of the borrower (mortgagor) and the lender (mortgagee).

- Property Description - A detailed description of the property used as collateral for the loan, including its address, legal description, and parcel number.

- Loan Details - The loan amount, interest rate, and terms and conditions of repayment, including the payment schedule.

- Mortgage Terms - Specific provisions related to the mortgage, such as whether it's a fixed-rate or adjustable-rate mortgage and any prepayment penalties.

- Signatures - Signatures of both the borrower and the lender, and notarization if required by law.

Involuntary Liens

You do not choose involuntary liens; they are imposed upon your property against your will for a debt you owe. These usually end up in foreclosure and lead to the loss of your home.

- Mechanic's Liens - A mechanic's lien is a tool contractors, laborers, and material suppliers use to get paid if they work for you and you refuse to pay them. They first impose the lien and then must sue you in court to enforce it. If they win, they can foreclose, sell your house, and will be paid from the proceeds.

- Tax Liens - If you fail to pay your annual property taxes on time, the county can impose a tax lien on your property. These are very serious because, within a short amount of time, if you do not pay, they will foreclose and sell your house at auction well below the fair market value.

- Judgment Liens - Creditors use judgment liens the way contractors use mechanic's liens. They file for the lien, and then if payment cannot be worked out, they will sue you in court for the right to foreclose and sell your house.

The Process of Property Liens in West Virginia

Since West Virginia observes different liens, putting one on a property differs depending on the type. The most commonly filed lien is the mechanic's lien. Contractors and similar parties may use the following process when filing a mechanic's lien in West Virginia:

- West Virginia does not require individuals to send preliminary notices before filing the form. However, they may send notice before work to further secure their rights. Individuals should note that only parties within the first three tiers of the project have lien rights in the state.

- Filling out the lien form is vital to ensuring validity. The state requires individuals to provide important information such as their details, the property owner's details, a description of the property, details of the work, materials or services, and dates of the work or supply. Individuals may attach a copy of their contracts, licenses, and other related documents to secure their rights further.

- The deadline for filing a mechanic's lien in West Virginia is 100 days after the individual last provides labor or supplies. Individuals record the lien with the County Clerk, paying their specified fees. Depending on the office, recording may be done in person, online, or through mail.

- After recording, the individual must notify the owner or agent of the lien's existence. The notice must be served within 100 days of filing. Although notice is not required for some parties, it helps secure lien rights. After notice, the lienholder has six months to enforce the lien. They may also release it if the property owner pays the debt or the parties agree.

Easements and Covenants

Easements and covenants are also essential to property records. They accompany deeds so that the new owner understands precisely what they are getting into.

Easements are rights of way that allow someone other than the owner to access the property for a specific purpose. If the town builds a road on private property, it can access it without asking first. Any new owners must abide by this grandfathered rule.

Covenants are rules about how owners can use the property. They are common with condos and gated communities. An example might be that no lawn decorations are allowed. When buying a property with covenants, the new owner must agree to the terms or face consequences.

Plats and Surveys

Plats and surveys are types of maps. They differ in that plats contain the boundaries of all neighboring properties, and surveys have only the boundaries of the target property.

A copy of the survey may be under the County Clerk containing the following information:

- Boundaries - The document may describe the property's boundaries by length and angle.

- Property Description - Surveys often contain a full legal land description.

- Property Owner - The record will likely include the landowner's name.

- Topographic Features - The document may show the presence of topographic features.

- Encroachments - The record will note any improvements or features going into or out of the property.

- Improvements - The study notes all the improvements on the land.

Property Descriptions and Boundaries in West Virginia

Did you know that each piece of real property has its own legal property description? These descriptions have map coordinates and a detailed description, including natural landmarks, making them easy to find.

Surveys are a process of land measurement. They define the exact coordinates and boundaries of a piece of real property. They are used before building new homes, installing underground utilities, and settling boundary disputes.

Boundary disputes erupt when one party believes another is encroaching on their land. These arguments are common and often end up in court, where a judge must decide the outcome. The courts usually rely on professional surveyors to provide testimony and determine the exact boundaries to settle disputes.

Foreclosures

When a home is in foreclosure, that will appear in property records. Foreclosure homes will be valued less than fair market value and can be complicated to sell. Many buyers won't want to deal with the hassles.

Pre-foreclosure homes have yet to be sold at auction, and they are still in the process of reclamation. This is an ideal time for investors to buy homes cheaply and sell them for profit. These pre-foreclosures will appear in property records as well.

Understanding Property Ownership in West Virginia

Owning your own land is a big deal in West Virginia. As a proud homeowner, you must pay your mortgage, insurance, and taxes on time. You must also maintain the property well to retain the value. As the homeowner, your name and address will appear in public property records.

There are various scenarios where you need to find the owner of a specific property. Thankfully, you can do so easily. Contact the county court clerk's office and ask for the most recent deed, which will tell you who owns it and where they live.

If you want to find out when a particular house was built, you can easily find it. Contact the local county court clerk's office and ask them for a copy of the oldest building permit. That will tell you who first owned it and when it was built.

Ownership History Records

Property doesn't just change hands through real estate sales. Often, someone leaves a property to another person in their will or gifts it to them while they are still alive. Occasionally, someone signs the deed to their house over to a creditor to pay off a debt.

What is a Chain of Title?

The chain of title refers to the entire list of people who have owned a property. It goes back to the first owner and is documented through public deeds filed with the county clerk's office.

Buying and Selling Property in West Virginia

Property records are most prevalent during real estate sales. Before the sale, the seller, buyer, realtor, and title company can use property records to gather all the pertinent information. Records, such as appraisals, insurance binders, deeds, etc., will be created and recorded during the process.

When buying property in West Virginia, do your due diligence by collecting as much information as possible to know what you are getting. Check the values of nearby homes, the taxes, and insurance, and look for any red flags like liens or foreclosures.

When selling property in West Virginia, sellers must disclose any material defects they are aware of, like a leaky roof or a crumbling foundation. If there are gaps in your knowledge, you can consult property records to fill in the blanks.

If you borrow money to buy the house, your lender will require title insurance. This insurance protects both of you against any legal claims of title on the property after the sale. Before closing, your title company or attorney will perform a property title search to look for issues.

Why Property Values Are Important in Real Estate Transactions

When reviewing property records, you will see property values. The average price of a home in West Virginia is $167,862. However, these values can change quickly based on the economy, interest rates, and the local real estate market. Property values appear in appraisals, assessments, insurance records, and mortgages. Realty websites often show a property's current fair market value (FMV).

County tax assessors use assessments to determine the value of each property within the county and set tax rates so everyone pays their fair share. These assessments do not necessarily match the fair market value of a property.

Appraisers use state-approved methods to derive property values for mortgage, loan, or estate planning purposes. They base their findings on the fair market value by comparing similar homes that have recently sold in the area.

What Factors Determine Property Values in West Virginia

The following factors may influence property values in West Virginia:

-

Natural Resources - The state has abundant natural resources, such as coal, natural gas, and timber. The accessibility of these resources can impact property values, raising them due to their growth potential.

-

Educational Institutions - Proximity to high-quality schools and universities can be a critical factor for families and thus increase property values. Morgantown may be an example.

-

Appalachian Landscape - West Virginia's scenic beauty, mountainous terrain, and access to outdoor recreational activities can attract buyers looking for second homes, vacation properties, or retirement destinations, influencing property values in these areas.

-

Local Amenities - The availability of recreational facilities, parks, shopping centers, restaurants, and cultural attractions can contribute to the overall appeal of a neighborhood or city and thus affect property values.

Maintaining and Amending West Virginia Property Records

The West Virginia courts have a system for maintaining records to ensure consistency across all counties. For example, when a new deed or other property record arrives, they stamp it with the date, time, and a numeric code to keep all records organized. That record immediately becomes a public record.

It's your responsibility to maintain your own property records. The agency that holds them won't do it automatically. You must be proactive and regularly examine them for any errors or inaccuracies.

Humans create property records, and they make mistakes. If you find any errors on your records, contact the county court clerk or other agency and ask them to fix them. You may need to supply documentation to prove the error.

You should also update property records when someone dies. To do this, bring the death certificate, will, and the person named as the beneficiary to the county court clerk's office, and they will draft a new deed with the new owner's name.

If you get married or divorced, you should also change the name on your property records. Bring your marriage or divorce certificate to the court clerk and ask them to update the records. They will draft a new deed with the new name(s).

The Role of the County Court Clerk's Office

County court clerks are elected officials. They file and record records, collect fees, and provide public records upon request. Berkley County outlines the various duties of the county court clerk's office.

How to Ensure Data Privacy for Property Records

Public records are open to anyone, anytime. Your information will appear in some property records when you buy property. For a real estate transaction to be legal, it must be recorded with the county court clerk in West Virginia. Therefore, there can be no private sales of property.

You can access public property records through the county clerk's office by visiting and requesting copies. You will have to pay a fee for copies. You can also try to find them online through the court website.

Property records are public for two main reasons. First, they preserve the public chain of title, showing the entire list of everyone who has ever owned the property. Second, it prevents a government entity from gaining too much power over the people.

Although you cannot remove all your information from public property records, you can minimize your exposure to identity theft and fraud by contacting the county clerk and other agencies that have your records and asking them to remove anything other than your name and address.

- 204 8th Street, Suite 100,

Marlinton, WV 24954 - (501) 459-4898

Instant Access to West Virginia Property Records

- Owner(s)

- Deed Records

- Loans & Liens

- Values

- Taxes

- Building Permits

- Purchase History

- Property Details

- And More!

Property Records Guide

- How to Access Property Records in West Virginia

- What Are Property Records?

- Types of Property Records in West Virginia

- Understanding Property Ownership in West Virginia

- Buying and Selling Property in West Virginia

- Maintaining and Amending West Virginia Property Records

- The Role of the County Court Clerk's Office

- How to Ensure Data Privacy for Property Records

- Barbour County

- Berkeley County

- Boone County

- Braxton County

- Brooke County

- Cabell County

- Calhoun County

- Clay County

- Doddridge County

- Fayette County

- Gilmer County

- Grant County

- Greenbrier County

- Hampshire County

- Hancock County

- Hardy County

- Harrison County

- Jackson County

- Jefferson County

- Kanawha County

- Lewis County

- Lincoln County

- Logan County

- Marion County

- Marshall County

- Mason County

- McDowell County

- Mercer County

- Mineral County

- Mingo County

- Monongalia County

- Monroe County

- Morgan County

- Nicholas County

- Ohio County

- Pendleton County

- Pleasants County

- Pocahontas County

- Preston County

- Putnam County

- Raleigh County

- Randolph County

- Ritchie County

- Roane County

- Summers County

- Taylor County

- Tucker County

- Tyler County

- Upshur County

- Wayne County

- Webster County

- Wetzel County

- Wirt County

- Wood County

- Wyoming County

Property Records Guide

- How to Access Property Records in West Virginia

- What Are Property Records?

- Types of Property Records in West Virginia

- Understanding Property Ownership in West Virginia

- Buying and Selling Property in West Virginia

- Maintaining and Amending West Virginia Property Records

- The Role of the County Court Clerk's Office

- How to Ensure Data Privacy for Property Records

West Virginia Property Resources

West Virginia Counties

- Barbour County

- Berkeley County

- Boone County

- Braxton County

- Brooke County

- Cabell County

- Calhoun County

- Clay County

- Doddridge County

- Fayette County

- Gilmer County

- Grant County

- Greenbrier County

- Hampshire County

- Hancock County

- Hardy County

- Harrison County

- Jackson County

- Jefferson County

- Kanawha County

- Lewis County

- Lincoln County

- Logan County

- Marion County

- Marshall County

- Mason County

- McDowell County

- Mercer County

- Mineral County

- Mingo County

- Monongalia County

- Monroe County

- Morgan County

- Nicholas County

- Ohio County

- Pendleton County

- Pleasants County

- Pocahontas County

- Preston County

- Putnam County

- Raleigh County

- Randolph County

- Ritchie County

- Roane County

- Summers County

- Taylor County

- Tucker County

- Tyler County

- Upshur County

- Wayne County

- Webster County

- Wetzel County

- Wirt County

- Wood County

- Wyoming County