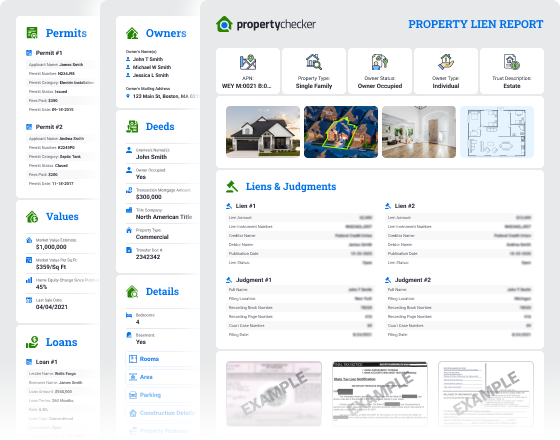

What Information Can You Find When Searching For a Lien on Property with PropertyChecker?

Liens can tell you a lot about the property and owners. When you use PropertyChecker for a property lien search, you can find the following vital information:

- Publication Date

- Record Last Updated

- Record Type

- Debtor Name

- Creditor Name

- Lien Amount

- Lien Instrument Number

- Lien Status

- And Much More!

Additionally, because PropertyChecker gathers information from dozens of public and private sources, you can also learn the following crucial property details:

- Loan Amounts

- Mortgages

- Loan Terms

- Rates

- Status

- Lender Information

- Associated Names

- Foreclosures

- And Much More!

Power of Property Data Under Your Fingertips

Liens & Judgments

- Property Deeds

- Property Liens

- Foreclosures

- Much More!

Owner Information

- Names

- Addresses

- Phone Numbers

- Emails

- Much More!

Property Values

- Sales History

- Market Value

- Equity

- Much More!

Mortgage Records

- Lenders

- Mortgage Amount

- Second Mortgage

- Much More!

Property Taxes

- Tax Bill Amount

- Assessed Value

- Tax Delinquency

- Much More!

Property Details

- Property Features

- Building Permits

- Parcel Info

- Much More!

Purchase History

- Sales History

- Past Sale Prices

- Sale Dates

- Transfer Types

- Much More!

Building Permits

- Dates

- Permit Types

- Business Type

- Fees, Status

- Much More!

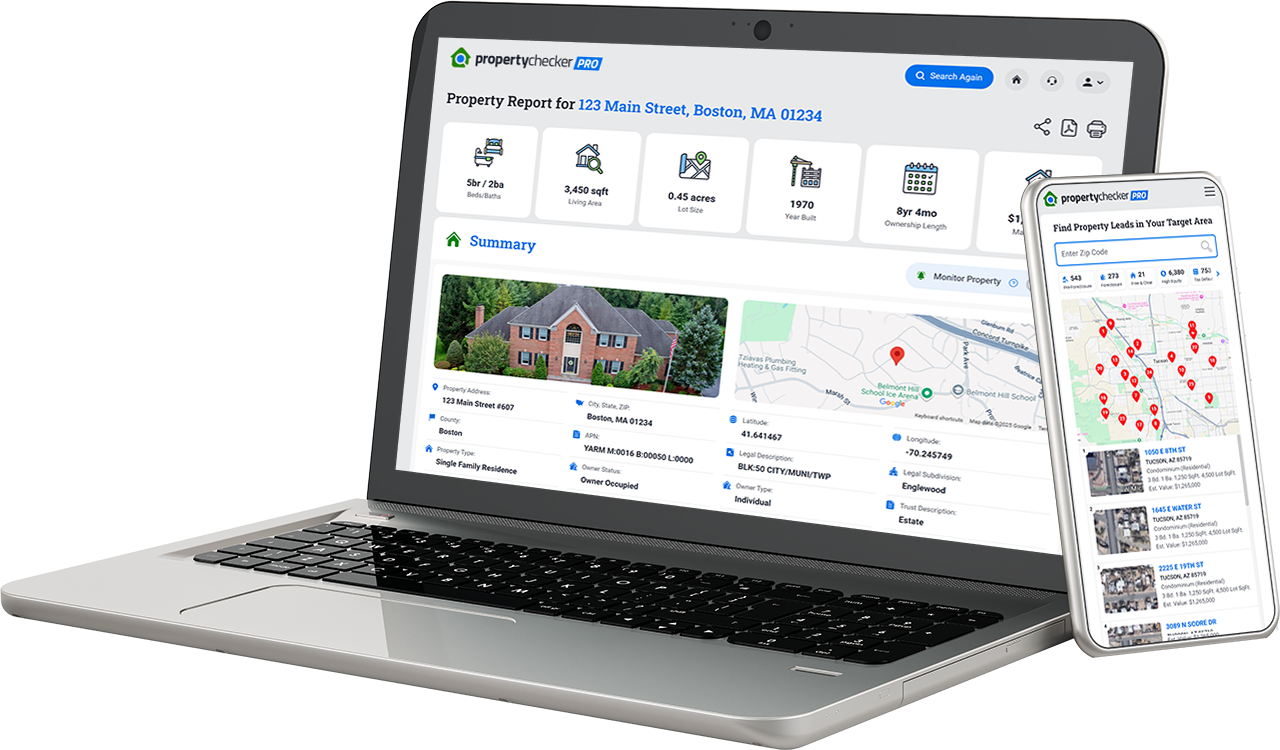

PropertyChecker is the most affordable and efficient way to find local and nationwide property records.

Our database covers over 158 million properties in over 3,000 counties and is updated daily.

Property liens are legal claims on real property for a debt owed by the property owner. Creditors, government agencies, and private contractors use liens to collect money. Liens are recorded and filed with the county records office, registry of deeds, recorder’s office, or with the courts.

Property liens come in two flavors: voluntary and involuntary. A voluntary lien occurs when an owner uses their property as collateral to secure a loan. An involuntary lien occurs when the county tax collector imposes a lien for unpaid property taxes.

Banks, credit unions, lenders, mortgage companies, contractors, tax officials, and creditors can file liens against a property if the owner does not pay the debt owed.

How to Search Property Liens by Address, Name, or Phone Number?

Liens are public records; anyone can search for a property lien by address to find all the details. Before buying a property, part of the due diligence is determining if a property has any liens and how serious they are. Liens must be cleared before a property can change hands. Do plenty of research before buying any property with more than one lien. Although mortgage liens are very common, judgment, tax, and mechanic’s liens are less common and could indicate trouble.

The first step is learning how to find a lien on a property. You can do that in a few different ways, detailed below:

County Recorder or Registry of Deeds Office

Depending on the state, you can search for liens and property records at the county recorder or registry of deeds office. Many have websites where you can do a lien check on property right there. These offices typically have deeds, liens, and foreclosure records. They may charge you a small fee per page if you visit in person.

County Assessor / Tax-Collector

The county tax collector or assessor’s office is responsible for property assessments and tax bills. When a property owner fails to pay their tax bill, the office may impose a tax lien on the property and eventually sell it at auction. You can contact these offices for a list of the latest liens or search for them online through the county website.

Secretary of State

The secretary of state is another government office that gets a copy of real property liens and may have them available on their website. You can also call this office or visit in person to obtain copies.

The Courts

Another way to run a property lien search is through the courts. Judgment and mechanic’s liens may be recorded with the court clerk. You can check online if they have a search tool or in person at the county courthouse.

Third-Party Websites

Third-party and commercial websites like PropertyChecker offer another way to perform a free property lien search and find what you need.

Search for liens by address, owner name, or phone number. If you are searching for foreclosure properties to buy, finding those with a lien can be paramount to your success.

Types of Property Liens

Liens are created to protect the interest of a bank, creditor, or someone who has worked on the property without getting paid. The most common types of liens consist of:

Mortgage Liens

A bank will only lend a buyer money to purchase a house by placing a lien on the property. If the borrower defaults on the loan, the lender can seize the house and sell it at auction to recover the money.

Tax Liens

Every property owner must pay annual property taxes. If they don’t pay, the local county tax official can attach a tax lien to the property, foreclose on it, and eventually sell it at auction to recoup the overdue taxes.

Mechanic’s Liens

When a contractor, architect, landscaper, etc., works on the property and the owner does not pay them for their work, they can file a lien and take the owner to court to get paid.

Judgment Liens

Creditors like credit card companies and loan originators can also file liens against homeowners to get paid. They must sue the owner in court, and if they win, they can foreclose and sell the property to get their money.

Frequently Asked Questions

How to look up a lien on property?

Use any of the resources listed above and check websites for search portals. Many have their records stored online, making it easy to search using the property address, owner’s name, or other criteria.

How to find out if there is a lien on a property?

You can perform a property lien search to find out if a specific property has a lien on it. Most have mortgage liens, but you may also find tax, judgment, or mechanic’s liens, which could pose a problem if you want to buy the property.

Can I transfer property with a lien?

Only if the buyer is willing to assume the lien as their own. Generally, liens must be paid off before transferring property to another person or entity. Transferring property with liens is not common.

What is a lien on a property?

A lien on property is a legal claim for a debt that the homeowner owes. The debt is paid off once the property is sold through the sale proceeds.

How to find out if there is a lien on a property?

Use PropertyChecker or one of the government resources to find liens on property before buying.

Can I sell a property with a lien?

You can, but the liens must be paid off first. Selling a property with serious liens may be complicated and require more money, time, and paperwork.

Access Every Feature You Need to Find, Analyze, and Invest in Properties

Find Investment Properties with 15+ Targeted Lead Lists

Gain access to 160+ million properties nationwide, backed by 248+ million mortgage and loan records and 300+ million building permits — all in one powerful platform.

Foreclosures

Pre-Foreclosures

Free & Clear

High Equity

Tax Default

Vacant Lots

Intra-Family Transfers

Out-of-State Owners

Not-a-Principal Residence

Recently Sold

Flipped Properties

Failed Listings

State Property Records

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Washington D.C.

- West Virginia

- Wisconsin

- Wyoming

Foreclosures

Foreclosures Pre-Foreclosures

Pre-Foreclosures Free & Clear

Free & Clear High Equity

High Equity Tax Default

Tax Default Vacant Lots

Vacant Lots Intra-Family Transfers

Intra-Family Transfers Out-of-State Owners

Out-of-State Owners Not-a-Principal Residence

Not-a-Principal Residence Recently Sold

Recently Sold Flipped Properties

Flipped Properties Failed Listings

Failed Listings